Webb Legacy Society

Through the benefits of planned giving, donors can leave a lasting legacy to USA Lacrosse and the USA Lacrosse Foundation. If you have made a planned gift to USA Lacrosse, please consider notifying us so that we may recognize you as a member of the A. Norman Webb Jr. Legacy Society.

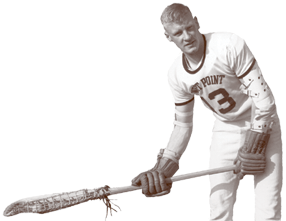

A standout goalie at Gilman School in Baltimore in the late 1950s and the US Military Academy in the 1960s, A. Norman Webb Jr. shared the sport everywhere he went, helping new players and starting new teams. He became known as the "Godfather of San Diego Lacrosse."

A standout goalie at Gilman School in Baltimore in the late 1950s and the US Military Academy in the 1960s, A. Norman Webb Jr. shared the sport everywhere he went, helping new players and starting new teams. He became known as the "Godfather of San Diego Lacrosse."

Norm deeply valued the sport, as well as the friendships and experiences it fostered. He envisioned the sport's potential and understood the resources needed to achieve it.

When Norm drew up his will, true to these beliefs, he gave nearly his entire estate to USA Lacrosse. His gift was transformational, serving as the catalyst for the creation of the new USA Lacrosse national headquarters in Sparks, Md.

The A. Norman Webb Jr. Legacy Society honors Norm's historic bequest and recognizes those who follow in his example of leadership by making a planned gift to USA Lacrosse Foundation.

"Norm had a lot of passion about the sport, and he wanted to see it played right. His leadership inspired people." - Mitch Fenton

Create Your Legacy

Every Gift Makes an Impact

For many of us, there is a compelling need to make a difference—to leave a lasting impact on our friends, family, and the sports that have shaped our lives.

As the sport’s governing body, USA Lacrosse provides leadership, structure, and resources to fuel the sport’s growth and enrich the experience of participants.

We strive to guide players of all levels towards opportunities that are safer and more fulfilling, where they can realize their own love for the game. We represent the entire community — U.S. National Teams and first-time players alike — and support the many, passionate advocates that make their dreams possible.

There are several easy ways to make an impactful gift that not only help USA Lacrosse continue it’s mission—but could help you, your estate, and your heirs.

Ways to Give

Gifts by Bequest: A bequest is perhaps the easiest and most flexible way to make a gift to USA Lacrosse. You can name us as a beneficiary in your will or living trust, designating the gift of a specifi dollar amount, a particular asset, a percentage of your estate, or the remainder of your estate once all of your other bequests have been fulfilled. With a bequest you maintain complete control of your assets during your lifetime, and can save on income taxes, capital gains taxes, and estate taxes.

Beneficiary Designation: It’s as simple as requesting a change of beneficiary form from the company holding your assets (for example, your IRAs, 401(k) and other retirement plans, bank accounts, commercial annuities, life insurance policies, and other assets) and including USA Lacrosse as a full or partial beneficiary. Beneficiary designations will reduce income taxes and possibly estate taxes for your loved ones.

Life Income Gift: Your gift to USA Lacrosse can also be designed to pay you income for life. A Charitable Gift Annuity is a popular way that both you and USA Lacrosse can benefit. In exchange for your charitable contribution, we agree to pay a fixed payment to you for life with the remainder benefiting USA Lacrosse. This type of gift is particularly attractive because you often can reduce taxes, increase your spendable income and, at the same time, make a gift that will have a substantial impact on our future. You benefit now and we benefit later.

Gifts of Retirement Assets: Retirement assets, such as a 401(k) or an IRA are a terrific way to make a tax-wise gift to USA Lacrosse. If you are 70½ or older you can rollover up to a certain amount each year from your IRA as a charitable gift. Tell your IRA administrator to transfer your gift directly to USA Lacrosse from your traditional or Roth IRA account. The gift will not be taxed as income to you.